(data source: KMR)

Workplace Television Viewing by Financial Professionals

Traditionally, television audience measurement is done through home-based people meter systems. As such, it is recognized that out-of-home viewing (e.g. bars, airports, offices, medical offices, schools, hospitals, etc) are excluded. In Ambient Television, Anna McCarthy wrote:

The growth of cable and the development of new audience measurement technologies and companies in this period inaugurated a crisis of confidence for the networks and the ratings systems on which their revenue framework was based, especially when new research allotted far larger audience shares to cable channels than previous studies had found. In 1993, as one of several strategies for drumming up larger audience figures, the networks entered into an unprecedented partnership. Under the aegis of the National Television Association they joined together in sponsoring a Nielsen study of out-of-home viewers. The study aimed to prove that more people were watching the networks than new ratings systems had suggested; and in fact it showed, conveniently, that of the twenty-eight million weekly out-of-home viewers, nineteen million watch network programming.

Despite the fact that this sudden concern with the out-of-home audience could only have stemmed from this ratings slide, professional commentators at the time endeavored to link the network interest in non-domestic viewers to an increased social and physical mobility on the part of the audience: NTA director of research Steve Singer claimed that "lifestyle changes in the 1990s ... a rise in the number of working women, college students, and business travelers ... indicates it is increasingly important for the industry to quantify all television viewing, regardless of viewing location, and to track the viewing behavior of these important demographic groups."

For the major broadcast networks,

out-of-home viewing may account for just a few percentage points.

But for a business television network such as CNBC, this becomes a major

issue, as their weekday daytime programming is expected to be heavily watched by

financial professionals in their workplaces.

This may be a relatively small audience, but it is affluent and

influential with investors. We will now cite some data from an October

2002 study conducted by KMR on the weekday daytime TV

viewing habits of financial professionals in the United States.

Commissioned by CNBC, the purpose of the study was to understand how financial

professionals use television and print media as information sources during the

workday.

Financial professionals form a rare

population with low survey participation rates.

Therefore, a traditional survey based upon screening the general

population would be terribly inefficient. In

the KMR study, the names were sampled from listings of employees at financial

institutions. The respondents were

recruited by priority mail sent to their offices and were asked to fill out a

survey over the internet. Whereas

internet surveys may not be representative of the general population (see, for

example, Using The Internet As A Survey

Tool ), this target group has nearly 100% internet penetration and

therefore the survey results are valid for this universe.

Within their work schedule, it is also easier for them to complete an

internet survey than the traditional surveys modes of face-to-face interviews,

telephone or mail surveys.

Close to 1,000 financial professionals were surveyed in a range of industries including commodities and securities, banking, holdings and trust, insurance companies and personal financial services. The survey included a quarter-hour diary of TV viewing by location (home, work, elsewhere) for a group of news and information channels, including CNBC, CNN, MSNBC, Fox News, ESPN, Bloomberg, CNN Headline News and CNN fn. The survey also included demographic, job function and purchase influence questions. The sample was chosen to reflect a universe of 1.3 million financial professionals, of which 300,000 worked in the securities/commodities industry.

From this survey, it was found that many

financial professionals spend time watching TV while on the job. The

quarter-hour rating for persons using television between 7am and 7pm was 10.6.

65% of this viewing was done outside the home between 7am

and 7pm and this percentage increased to 82% between 9am and 5pm.

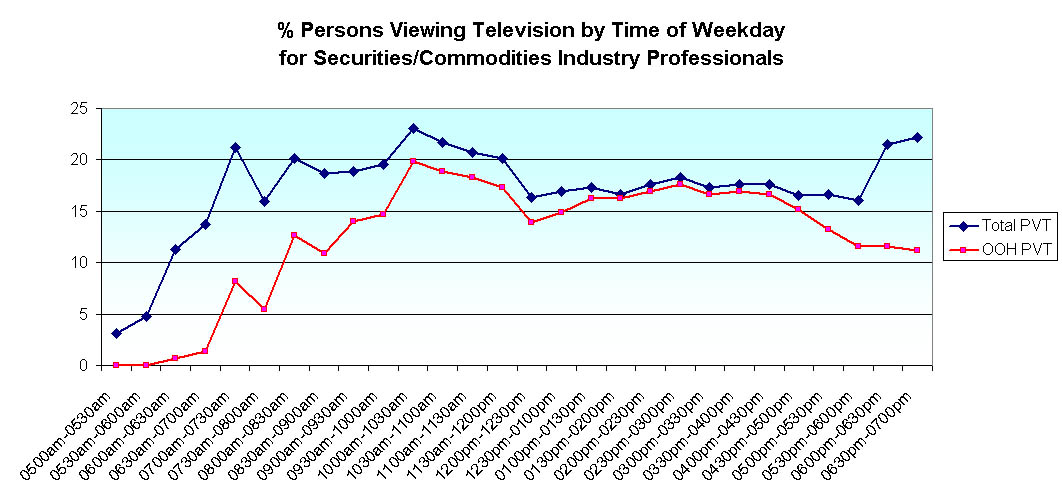

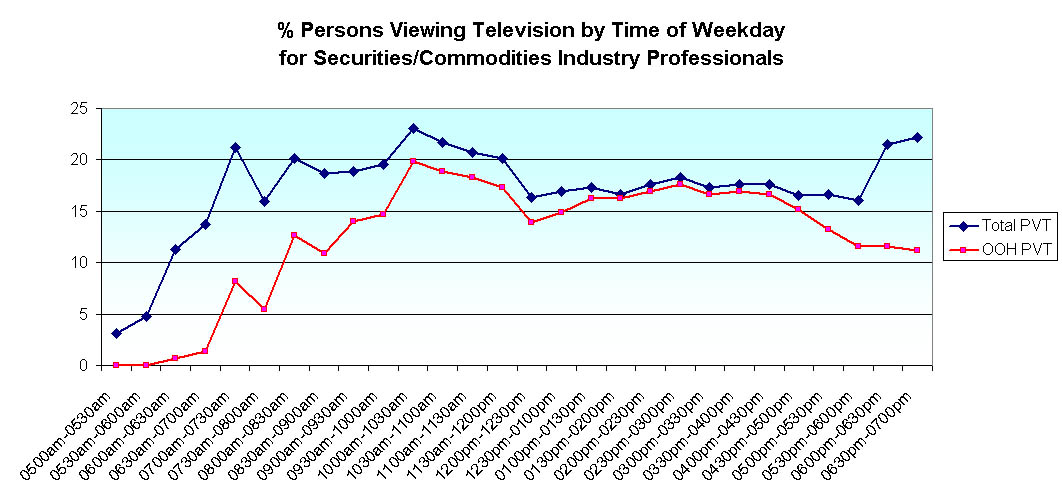

The next chart shows the percent of persons viewing television (both the total

and the out-of-home portions) by time of weekday for financial professionals in

the securities/commodities industry.

(data source: KMR)

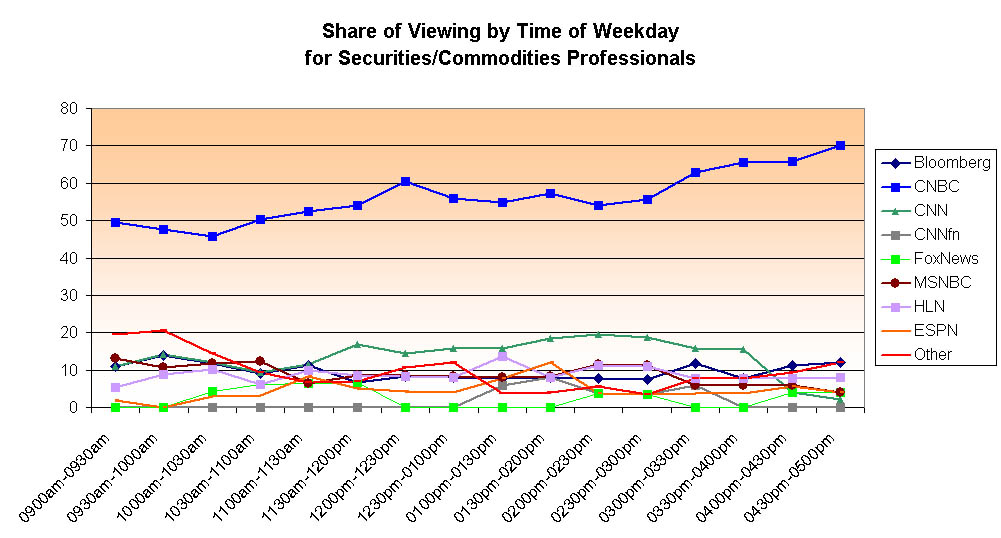

Much of this out-of-home viewing was purposeful. The television set was not there to serve as passive background, as 80% of this viewing was done with the sound on. Furthermore, the television set was seldom tuned to movie channels or daytime drama. After all, it would be difficult to imagine how so many of these highly-paid professionals could be watching television for entertainment during office hours. Instead, the television viewing was nearly always done to meet the need for business information. Between 5am and 5pm, 96% of the viewing went to the business and news channels CNBC, CNN, MSNBC, Fox News, Bloomberg, CNN Headline News and CNNfn. Among the measured cable networks, CNBC had the highest average rating for financial professionals, with an average rating of 4.3 between 5am and 5pm, for a 47% share of the total audience.

Among the financial professionals, those in

the securities industry watch the most amount of television.

Understandably, their business is to follow the market and therefore

up-to-date information is critical to their missions. Among securities professionals, the average quarter hour rating is

18.7 between 7am-7pm and 18.5 between 9am-5pm.

CNBC had an average quarter hour rating of 10.4 between 9am and 5pm, for

a 56% share of the total audience. The

next highest ranked cable network has a share of only 13%.

Clearly, CNBC is the clear and away leading television resource for

securities professionals. The next chart shows the share of viewing by

time of weekday for the financial professionals in the securities/commodities

industry.

(data source: KMR)

For CNBC, these survey results were extremely significant. Workplace television viewing behavior is not captured in the home-based people meter systems. Yet, as the KMR study was able to document, CNBC has a dominant position among financial professionals during the workday. In fact, given the nature and influence of CNBC's program contents, it is difficult to see why not everyone is watching it. The impact of CNBC goes beyond these financial professionals, as the information will get passed along to their peers and clients during the regular course of business.

CNBC is a global network, with a presence in Europe and Asia too. The same phenomenon in this article is replicated elsewhere. For example, this Hindu Business Line article reports on CNBC India: "According to Mr Chawla, the channel's true viewer strength programme to programme is difficult to assess in terms of number of viewers primarily because the audience does not figure in TAM's ratings. People meters to assess viewership strength is normally not placed in offices, where most of CNBC viewing takes place, according to Mr Chawla. Besides, most of CNBC's viewership is an upscale audience, he said."

(posted by Roland Soong, 4/26/2003)

(Return to Zona Latina's Home Page)